Paper prices are going up. Again. Prices for our industry’s most important raw material have been increasing several times over the last two years, with three significant increases in March, July and December 2021.

There are several reasons:

Pulp pricing increased dramatically

Pulp is the base for paper. The price for pulp has gone up by 40% just in Q1 this year. Numbers for plastics used in rigid point of sale materials are similar. Reasons for this are high demand for fibre based packaging due to environmental concerns, high demand from the rebounding building industry and consolidation of global pulp producers.

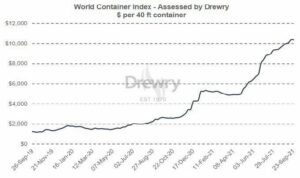

Shipping costs have increased even more dramatically, while reliability has plunged

The price for a container load have increased by almost 1000% over the last 12 months, due to a container shortage and an increase in landing costs, driven by reduced labour capacity and increased volumes of physical goods shipped in 2021. On top of that, shipments don’t arrive in the usual timeframes. The reliability of shipments arriving on time is at a record low, with 35% in the first quarter of 2021.

At SOS, we have recently had a few occasions when stock deliveries were delayed and we had to find alternatives for our clients, luckily so far these have been exceptions. Some of our specialised inkjet stocks usually have a three months lead time, this year we have to add at least another 90 day cushion to our schedules to make sure we have continuous supply.

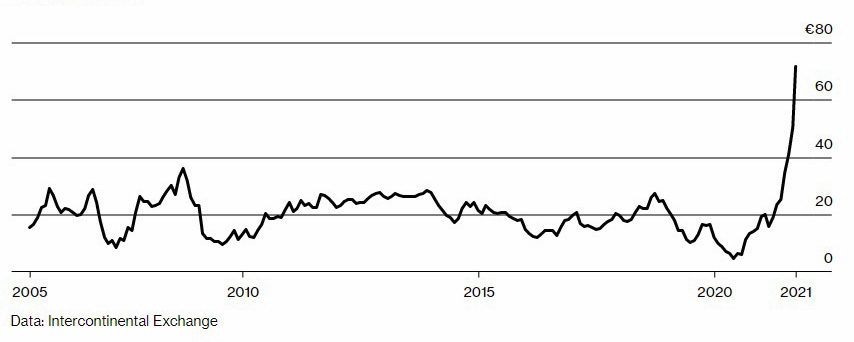

Energy Prices in Europe soar

Another factor is the Energy price in Europe, which has soared drastically in the third quarter of 2021. This has led to European paper mills placing an “Energy Surcharge” on all orders – and retrospectively on some orders even after placed and agreed. We have seen additional charges between 100 and 150 Euro per ton of paper in October for paper we buy from mills in Italy and the Netherlands. German mills have similar surcharges and costs in the UK are affected as well.

Paper mills have closed or reduced their production

Paper mills in Asia, Europe and America have all reacted to the reduced demands during the beginning of the pandemic and either closed completely or drastically reduced production.

There is only a very small amount of paper produced in Australia and several mills have closed down in the last few years.

The number of merchants in Australia is down to two

While we had several paper merchants to chose from ten years ago, now there are only two significant merchants left, Spicers and Ball Doggetts, both owned by Japanese groups. This means a loss of competition, and in most cases there is only one exclusive supplier option for a particular stock/grade. It has also lead to a loss of variety, with many stocks just not available in Australia – unless you are able to order enough to fill a whole container and import it independently.

What can we do?

The increased material prices and shipping costs are forecast to remain at least for another year, with a high level of unpredictability and volatility in the foreseeable future. We will closely watch the market and ensure that we discuss all options with our suppliers and our customers. It will be difficult to guarantee unchanged competitive rate cards for long term contracts, but we will find arrangements where we work with our clients to minimise the impact of increases and avoid gaps in availability.